LEARN. TRADE. INVEST.

The Ultimate Online Course for Beginner Traders and Investors

Trade & Invest with Confidence: 10 Essential Modules for Beginners, Taught by a Trader with 16 Years of Experience and Bundled into a 12-Hour Online Audio-Visual Course.

Scroll Down for A Clip from Each Module

Market Basics

This module is designed to provide an introduction to the fundamentals of financial markets. You will learn about the key concepts and terminology used in the markets, as well as the mechanics of how markets work.

You will learn how the bid-ask spread can be used as an indicator of liquidity as well as other factors that can impact liquidity, and how it can vary across different markets and securities. We go over all of the various order types and time-in-force definitions used when placing orders in the market. And we discuss the differences between trading and investing and proper risk management strategies.

Foreign Exchange (FX)

The currency market is the largest and most liquid market in the world with an average daily trading volume of over $5 trillion. This module covers the mechanics of the FX market including how currencies are quoted and traded, as well as the factors that affect currency exchange rates.

You will also learn about different trading strategies and techniques that can be used to speculate on the movement of currency prices.

You will also learn about the role of central banks and governments in the foreign exchange market, and how their policies can affect currency values.

Futures

With Futures trading, a trader agrees to buy or sell an underlying asset at a specified price and date in the future. These assets can include commodities such as gold and oil, and financial instruments like currencies, interest rates, and equity indices.

The use of futures contracts allows traders to hedge against price fluctuations or speculate on future price movements. This module will cover the basics of futures trading, including the mechanics of buying and selling futures contracts, the role of margin and leverage, and the different types of market participants involved in the futures market.

Market Basics

This module is designed to provide an introduction to the fundamentals of financial markets. You will learn about the key concepts and terminology used in the markets, as well as the mechanics of how markets work.

You will learn how the bid-ask spread can be used as an indicator of liquidity as well as other factors that can impact liquidity, and how it can vary across different markets and securities. We go over all of the various order types and time-in-force definitions used when placing orders in the market. And we discuss the differences between trading and investing and proper risk management strategies.

Foreign Exchange (FX)

The currency market is the largest and most liquid market in the world with an average daily trading volume of over $5 trillion. This module covers the mechanics of the FX market including how currencies are quoted and traded, as well as the factors that affect currency exchange rates.

You will also learn about different trading strategies and techniques that can be used to speculate on the movement of currency prices. You will also learn about the role of central banks and governments in the foreign exchange market, and how their policies can affect currency values.

Futures

With Futures trading, a trader agrees to buy or sell an underlying asset at a specified price and date in the future. These assets can include commodities such as gold and oil, and financial instruments like currencies, interest rates, and equity indices.

The use of futures contracts allows traders to hedge against price fluctuations or speculate on future price movements. This module will cover the basics of futures trading, including the mechanics of buying and selling futures contracts, the role of margin and leverage, and the different types of market participants involved in the futures market.

Equities (Stocks)

This module covers the mechanics of buying and selling stocks, and provides students with an understanding of the various exchanges, regulations and different type of equities available for trading.

We also cover the fundamental analysis of stocks using equity ratios, which give us an idea of the financial health and performance of a company relative to it’s peers.

By the end of this module, you will have a solid understanding of the mechanics of equities trading, be able to analyze companies and make informed investment decisions, and develop strategies for managing their equity portfolio.

Options

Options give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price and date. Options can be used for a variety of purposes, including hedging, speculation, and income generation.

There are two types of options: Calls and Puts. But there are countless strategies that can be applied to both or combinations of each. This module covers the mechanics of option trading including how the 'Greeks' and implied volatility affect the pricing of options.

By the end of this module, you will be able to create and execute options strategies with a varying degree of risk profiles for your option portfolio.

Bonds

In this module, we cover the basics of bond investing, including the different types of bonds such as Treasury bonds, municipal bonds, and corporate bonds.

You will also learn about the key characteristics of bonds such as the coupon rate, maturity date, yield, and credit rating.

You will learn how to analyze bonds and the risks involved in bond investing. We will cover credit risk, interest rate risk, and inflation risk and how they affect bond prices. The module will also cover the various forms of bond market participants and their role in the bond market and what the bond market looks like in different economic environments.

Equities (Stocks)

This module covers the mechanics of buying and selling stocks, and provides students with an understanding of the various exchanges, regulations and different type of equities available for trading.

We also cover the fundamental analysis of stocks using equity ratios, which give us an idea of the financial health and performance of a company relative to it’s peers.

By the end of this module, you will have a solid understanding of the mechanics of equities trading, be able to analyze companies and make informed investment decisions, and develop strategies for managing their equity portfolio.

Options

Options give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price and date. Options can be used for a variety of purposes, including hedging, speculation, and income generation.

There are two types of options: Calls and Puts. But there are countless strategies that can be applied to both or combinations of each. This module covers the mechanics of option trading including how the 'Greeks' and implied volatility affect the pricing of options.

By the end of this module, you will be able to create and execute options strategies with a varying degree of risk profiles for your option portfolio.

Bonds

In this module, we cover the basics of bond investing, including the different types of bonds such as Treasury bonds, municipal bonds, and corporate bonds.

You will also learn about the key characteristics of bonds such as the coupon rate, maturity date, yield, and credit rating.

You will learn how to analyze bonds and the risks involved in bond investing. We will cover credit risk, interest rate risk, and inflation risk and how they affect bond prices. The module will also cover the various forms of bond market participants and their role in the bond market and what the bond market looks like in different economic environments.

Macroeconomic Data

Macroeconomic data refers to a wide range of economic indicators that measure the performance and health of an economy as a whole. These indicators include GDP, inflation, employment, trade, and interest rates, among others.

By analyzing macroeconomic data, investors and traders can gain a deeper understanding of the broader economic environment in which they are operating and make more informed investment decisions.

By the end of this module, you will have a solid understanding of the key macroeconomic indicators and their significance, and be able to use this data to make more informed investment decisions.

Technical Analysis

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. The goal of technical analysis is to identify patterns and trends that can indicate future activity. Technical analysts use charts and other tools to evaluate securities and make trading and investment decisions.

This module will cover the various chart types, indicators, patterns and formations. You’ll learn about the role of trends and how to identify them.

You will gain a solid understanding of the basics of technical analysis and how to use charts, indicators, and other tools to identify patterns and trends in the market, and make more informed investment decisions.

Trading Tools

Trading tools such as brokers, platforms, charting software, and news sources are essential for traders and investors to make informed decisions in the financial markets. In this module, you will learn about the different types of trading tools available and how to use them effectively.

I'll share my main requirements when choosing a broker. I'll show you which charting software and analysis tools I use and why. And I'll show you where I get my news from.

By the end of this module, you will have a solid understanding of the various trading tools available, and how to use them effectively to make informed decisions in the financial markets.

Macroeconomic Data

Macroeconomic data refers to a wide range of economic indicators that measure the performance and health of an economy as a whole. These indicators include GDP, inflation, employment, trade, and interest rates, among others.

By analyzing macroeconomic data, investors and traders can gain a deeper understanding of the broader economic environment in which they are operating and make more informed investment decisions.

By the end of this module, you will have a solid understanding of the key macroeconomic indicators and their significance, and be able to use this data to make more informed investment decisions.

Technical Analysis

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. The goal of technical analysis is to identify patterns and trends that can indicate future activity. Technical analysts use charts and other tools to evaluate securities and make trading and investment decisions.

This module will cover the various chart types, indicators, patterns and formations. You’ll learn about the role of trends and how to identify them.

You will gain a solid understanding of the basics of technical analysis and how to use charts, indicators, and other tools to identify patterns and trends in the market, and make more informed investment decisions.

Trading Tools

Trading tools such as brokers, platforms, charting software, and news sources are essential for traders and investors to make informed decisions in the financial markets. In this module, you will learn about the different types of trading tools available and how to use them effectively.

I'll share my main requirements when choosing a broker. I'll show you which charting software and analysis tools I use and why. And I'll show you where I get my news from.

By the end of this module, you will have a solid understanding of the various trading tools available, and how to use them effectively to make informed decisions in the financial markets.

Long-Term ETF Investing

In this module, you will learn about the basics of ETFs and how they differ from traditional mutual funds. You will learn about the different types of ETFs available, such as index-based ETFs, actively-managed ETFs, and ETFs based on commodities or currencies. You will also learn about the key features and benefits of ETFs such as low cost, diversification and liquidity, and how they can be used to gain exposure to a specific market or sector.

The module covers how to research and select ETFs for a long-term investment portfolio, including how to analyze ETFs and how to assess their performance. It will also cover how to use ETFs to create a diversified portfolio and to create a strategy for re-balancing and managing an ETF portfolio.

Long-Term ETF Investing

In this module, you will learn about the basics of ETFs and how they differ from traditional mutual funds. They will learn about the different types of ETFs available, such as index-based ETFs, actively-managed ETFs, and ETFs based on commodities or currencies. You will also learn about the key features and benefits of ETFs such as low cost, diversification and liquidity, and how they can be used to gain exposure to a specific market or sector.

The module will cover how to research and select ETFs for a long-term investment portfolio, including how to analyze ETFs and how to assess their performance. It will also cover how to use ETFs to create a diversified portfolio and to create a strategy for re-balancing and managing an ETF portfolio.

OR

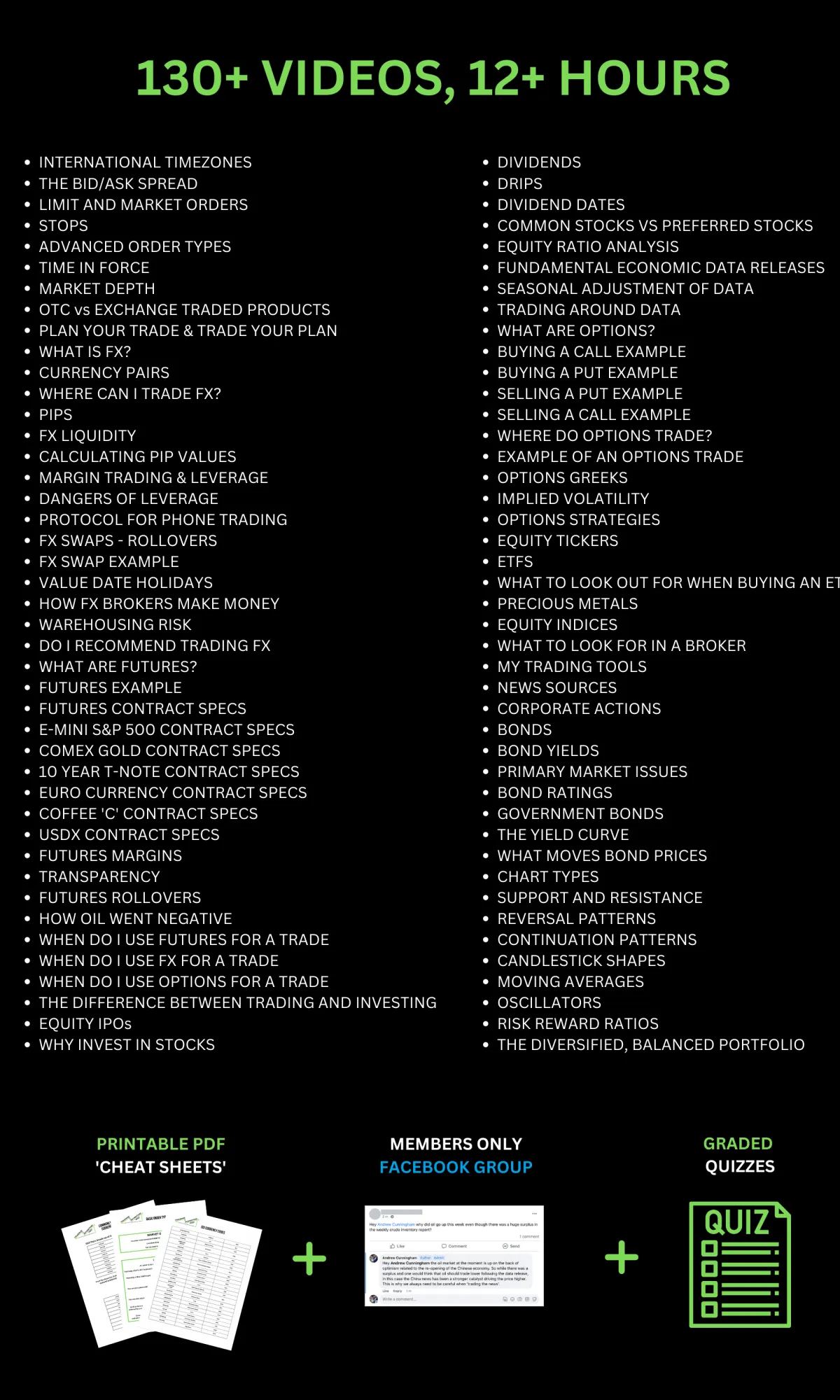

WHAT'S INSIDE?

HOW MUCH DOES IT COST?

$999+ VALUE

FOR A LIMITED TIME OFFER:

Lifetime Membership

$499

One Upfront Payment

Lifetime Access to ALL Content

Billed ONE time only

Stream all 130+ Videos anywhere, anytime

Access FUTURE Videos

FB Group Access for LIFE

30 Day Refund Policy

Multiple Choice Tests

30 DAY REFUND POLICY

Don't love our product? As long as you haven't watched more than 50% of the course videos, we offer full refunds within 30 days, no questions asked.